Asian iron ore prices are forecast to continue to be under downward pressure due to China's policy of restricting steel output. The Chinese government's further restrictions on steel production to ensure clean air are weighing on iron ore market sentiment.

In just the last 3 trading sessions, iron ore prices have lost about 10%, extending a decline that has lasted for many weeks.

China's iron ore prices fell to their lowest level in nearly two weeks on October 14 as China's demand outlook dimmed as Beijing appeared more aggressive in cutting steel output, with plans to set production control until the first quarter of 2022.

Accordingly, the price of iron ore for January 2022 on Dalian exchange - the most traded contract - on the morning of October 14 sometimes fell to 712 yuan / ton, the lowest level since September 30 and decreased. 3% compared to the close of the previous session. This contract fell 5.9% in the session of October 13 and decreased by 0.2% in the session of October 12.

On the Singapore floor, the price of iron ore for November term on the morning of October 14 also plunged 3%, before recovering to $122.65 per tonne at noon on October 14. In the previous session, October 13, this contract fell 4.4%, and the previous session, October 12, dropped sharply by 7.4%.

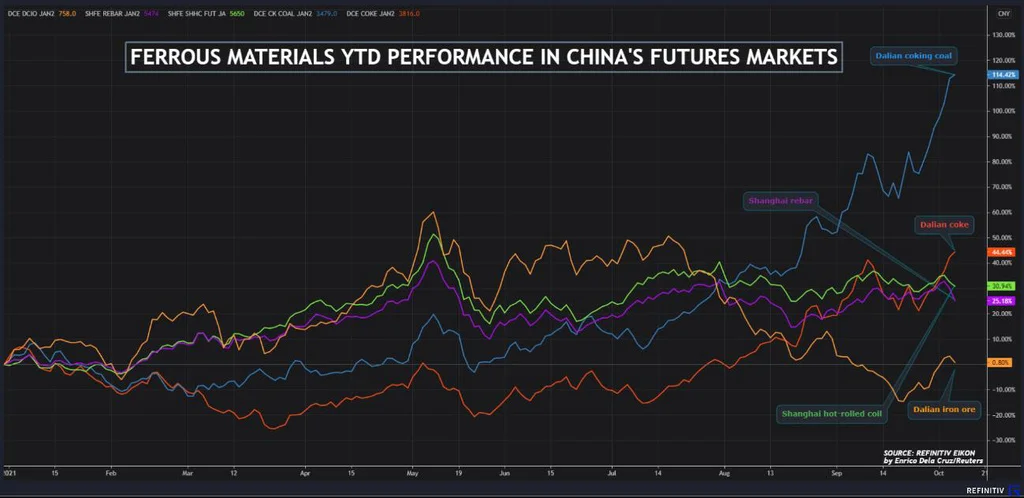

Imported iron ore (62% content) for immediate delivery at China's seaport is currently 106.5 USD/ton, down 46% from the record high in mid-May.

Steel mills in the region, especially those that produce steel using blast furnace technology, will be ordered to cut output based on their emissions levels. Although mills using electric arc furnaces can take voluntary measures to reduce emissions, they still have to ensure their steel output is not higher than in the same period last year.

"Local governments are required to fulfill their duties by providing economic support measures (for companies)," the environment ministry's announcement said. Accordingly, local governments are responsible for ensuring that the production facilities that are required to close are closed and that production cuts are enforced.

Meanwhile, the Ministry of Environment also plans to include more cities in the winter air pollution campaign in 2021, following the Winter Olympics in Beijing and the festival in Zhangjiakou city. ) in early February 2022.

Citi's analysts said China's target to reduce steel output in the first quarter of 2022 was "more drastic than market expectations". Accordingly: "If we assume that other places in China (besides Beijing and Hebei province adjacent to the capital) keep steel production unchanged, then national steel production in the first quarter of 2012 will decrease by 12% compared to that of the capital. compared with the same period last year, after having grown by 5% in the first 8 months of 2021 and decreased by 9% in the period of September-December 2021 (year-on-year).

Meanwhile, Chinese property developers face payment deadlines before the end of the year, and China Evergrande Group's condition worsens, raising fears of a financial crisis. The crisis spread in the housing sector, which accounts for about a quarter of China's steel demand.

The above problems, along with the global energy crisis, the demand for iron ore may recover overnight. The downward trend in iron ore prices is expected to continue.